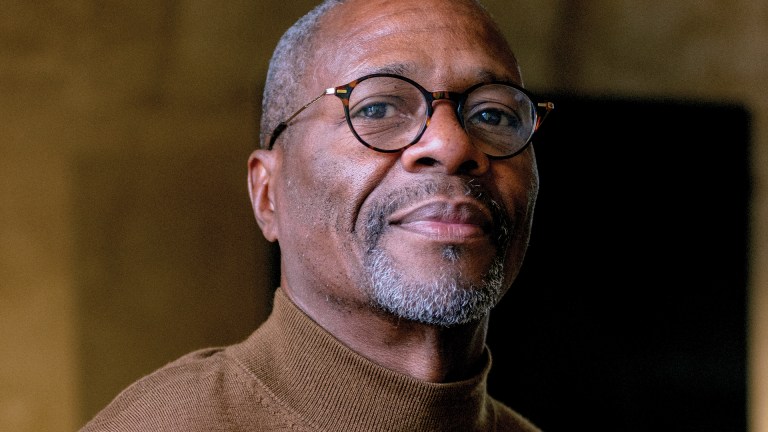

By Danyal Sattar, Big Issue Invest CEO

I’ve had a week of being out at social investment sector events. Across three different events this week, I had the sense that we are experiencing a real shift in the way finance views its impact on people and the planet.

I am not always so change conscious. Those of you who know me well, know I like to put social investment into the context of a long history of investing. Typically I hark back to 1542 when Sir Thomas White set up his eponymous loan charity in Leicester, to lend to apprentices so they could buy their own tools and become master craftsmen. By making these loans, apprentices who were too poor to afford their tools, could buy them and make the step up in status and income accordingly. So as an industry, we social purpose investors have been around for a long time.

I hear a number from the Principles for Responsible Investment of $1.3 trillion of funds in impact investment, or from the Global Impact Investors Network with a narrower definition of £228 billion of impact investment assets under management, doubling from the previous years. Here in the UK, Big Society Capital (BSC) estimates some £2bn of social investments under management, focusing on a tighter cohort of eligible social sector organisations (charities, social enterprises and other asset locked organisations).

The Sir Thomas White Loan Charity still operates to this day in Leicester. But looking at the numbers above, does make me wonder if we are indeed seeing a step change in the world in which Big Issue Invest operates.

It was in Leicester that we gathered for two days to take stock of the social investment sphere during our bi-annual social investment industry gathering. One of the questions we asked ourselves was whether we were already history. Had this new world, of professional fund managers, focused on the sustainable development goals, with large billion pound funds, overtaken us? Later in the week, I attended the British Venture Capital Association’s Minorities Breakfast. The speaker was a black woman entrepreneur who had started her own investment fund, Good Soil. The room was full of a diverse group of people, all from mainstream financial institutions.