· offering grant funded wrap-around support across the investment process (from early stage enterprises to established organisations, and pre-investment to post investment)

· addressing sector representation head on, actively committed to ensuring that the team, management and governance of the fund are more representative of the Founders the fund looks to support.

Social entrepreneurs will be represented across the Advisory Board and Investment Committee, bringing their lived experience and expertise to making decisions for their peers. Their voices will hold the fund to account in being fit for purpose, inclusive, accessible, and meeting the needs of diverse founding teams.

The funding will go towards investing directly in founding teams, as well as the technical assistance fund, a grant pot that will enable social entrepreneurs who face barriers to access to start their investment journey. This could be used to fund, for example, childcare, transport, marketing support or other associated costs.

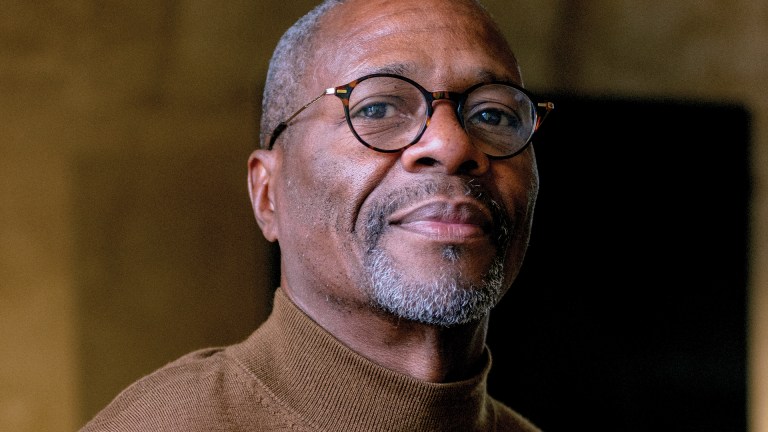

Bernard Mensah, President of International at Bank of America, comments, “Through the Growth Impact Fund, we hope to catalyse and unlock finance for social entrepreneurs where it is most desperately needed. We are committed to helping tackle social inequality today and the building of sustainable solutions for the next generation and beyond.”

Seb Elsworth, chief executive of Access – the Foundation for Social Investment said, “Access launched its Flexible Finance for the Recovery programme in order to stimulate innovation in the types of financial products available to social enterprises. A core motivation for this was to ensure a flow of capital to parts of the market that are underserved, often minoritised groups and communities that have too often been excluded by previous investment programmes. The Growth Impact Fund tackles both of these elements head-on in an extremely bold and targeted way, and Access is delighted to provide early financial backing to enable other investors to come on board.”

Head of Investment at UnLtd, Mathu Jeyaloganathan, has been a driving force in bringing the Growth Impact Fund to life:

“The Adebowale report highlighted that the social investment sector has not done enough to prioritise the needs of social enterprises, and in particular that it has serious problems with race. This fund was created to address that. As passionate as we at UnLtd are about change, it won’t be possible without the help of like-minded investors and partners, so we are absolutely delighted that both Bank of America and Access have come on board to make social investment work better for social entrepreneurs.”

Investment Director at Big Issue Invest, Jonny Page, said:

“We believe, alongside our partners, UnLtd and Shift, that much more has to be done to make investment inclusive. We are on a journey to do just that and we could not do this without the support of Bank of America and Access. They are enabling and supporting this transformative new impact fund: a fund that recognises and celebrates diversity, prioritises the social entrepreneur in every aspect of its design, and is built on partnerships and support to unlock growth. Our fund is committed to tackling inequality across the UK by investing into leaders from underrepresented backgrounds, as we continue to back human potential as part of Big Issue Invest’s impact strategy.”

The Growth Impact Fund will be launching later in 2022.

For more information, visit http://www.bigissueinvest.com or www.unltd.org.uk or email

enquiriesGIF@bigissueinvest.com.