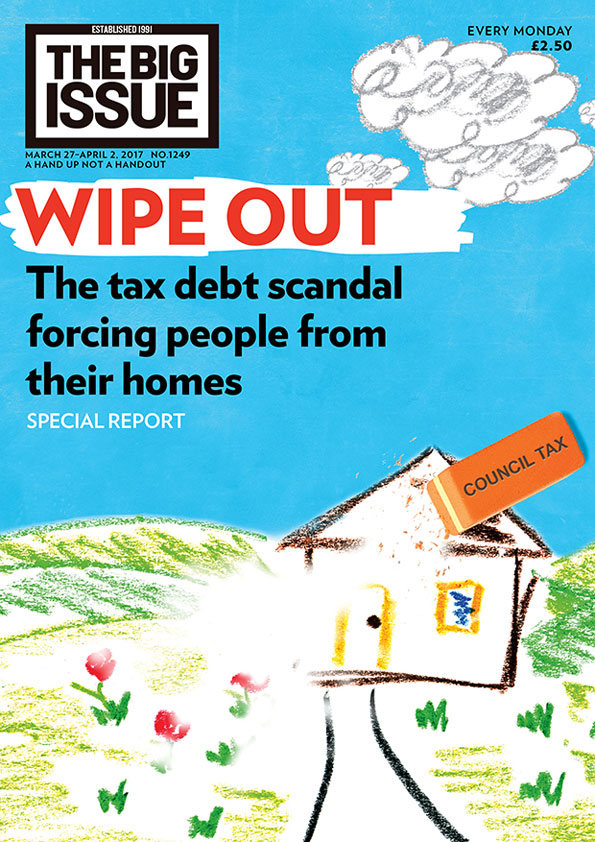

Not since the witch trials of the 17th century, or the ill-fated poll tax which ended the premiership of Margaret Thatcher in 1990, have so many vulnerable and impoverished people ended up being taken to court at one time, as is now happening with the council tax. Not only has council tax debt become Britain’s biggest personal debt problem – eclipsing credit card default in 2014 – but it is also a cause of homelessness, with the danger not confined only to those in rented accommodation. It is also striking homeowners as cash-strapped councils implement ever harsher recovery tactics.

The period 2013-2016 saw a 40-50 per cent increase in the number of people taken to court for council tax non-payment, as revealed in the Ollerenshaw report on council tax support schemes, presented to parliament in March last year. Now, in 2017, more than three million people can expect to be issued with a liability order made by magistrates’ courts in England and Wales or by the sheriff court in Scotland.

Adults of working age face paying up to 45% of annual council tax, even if unemployed or on means-tested welfare

Unsurprisingly, the liability order is now the most commonly issued court judgment in the UK. Relatively few debtors actually attend their hearings, and in the absence of representation, the few who do can seldom effectively defend themselves, or seek adjournments or appeal. Councils discourage attendance, and corner-cutting can be rife, most hearings providing little more than a rubber-stamping of the debt and an opportunity for the local authority to impose extra costs.

The actual cost of summonsing is £3, yet councils are routinely adding amounts of £100 or more for undefined ‘court costs’ on to the amount owed in tax, for what is an almost entirely computerised process. Worse still, many debtors may not even realise a liability order has been granted until a bailiff comes knocking – frequently the first human actually encountered. But the use of bailiffs is only one of a raft of severe enforcement measures. When pursuing council tax, local authorities have extraordinarily wide powers, including methods that result directly in the taxpayer losing their home.

Once armed with a liability order, not only can a local authority send in bailiffs but it can deduct from your wages or benefits and, if you are a homeowner, pursue a charging order to sell your house or flat or make you bankrupt. In England and Wales (though not Scotland) defaulters with means may be imprisoned for up to three months. Enforcement by these measures can all cause loss of your home, by either making existing housing liabilities unsustainable or by bankruptcy and charging orders, which trigger further costly court action.

Such is the complexity of the council tax system and recovery that local authorities often lose control of their own processes. Mistakes easily accumulate, a product of fragmented decision-making involving a long line of seemingly small steps, which the beleag-uered debtor is unable to correct or alter. With bankruptcy and charging orders, the sums owed spiral to pay fees claimed by insolvency practitioners and debt lawyers, and courts themselves often do not properly understand the law. It is ultimately enforcement costs – far exceeding the tax concerned – that lead to debtors losing the roof over their heads. Furthermore, recovery proceedings can be begun in error, often concerning alleged overpayment of benefits from earlier periods which taxpayers struggle for months or even years to resolve.