“Extending the HSF is far from the solution to the UK’s policy-driven poverty crisis but it will certainly go some way to temporarily help food insecure households as well as food banks to get through the next few months. Its removal in October would be ill-conceived and extremely damaging. We hope this six-month extension is the first step towards ensuring crisis support is permanently in place, well-funded, well-promoted and easily accessible in local authorities across England.”

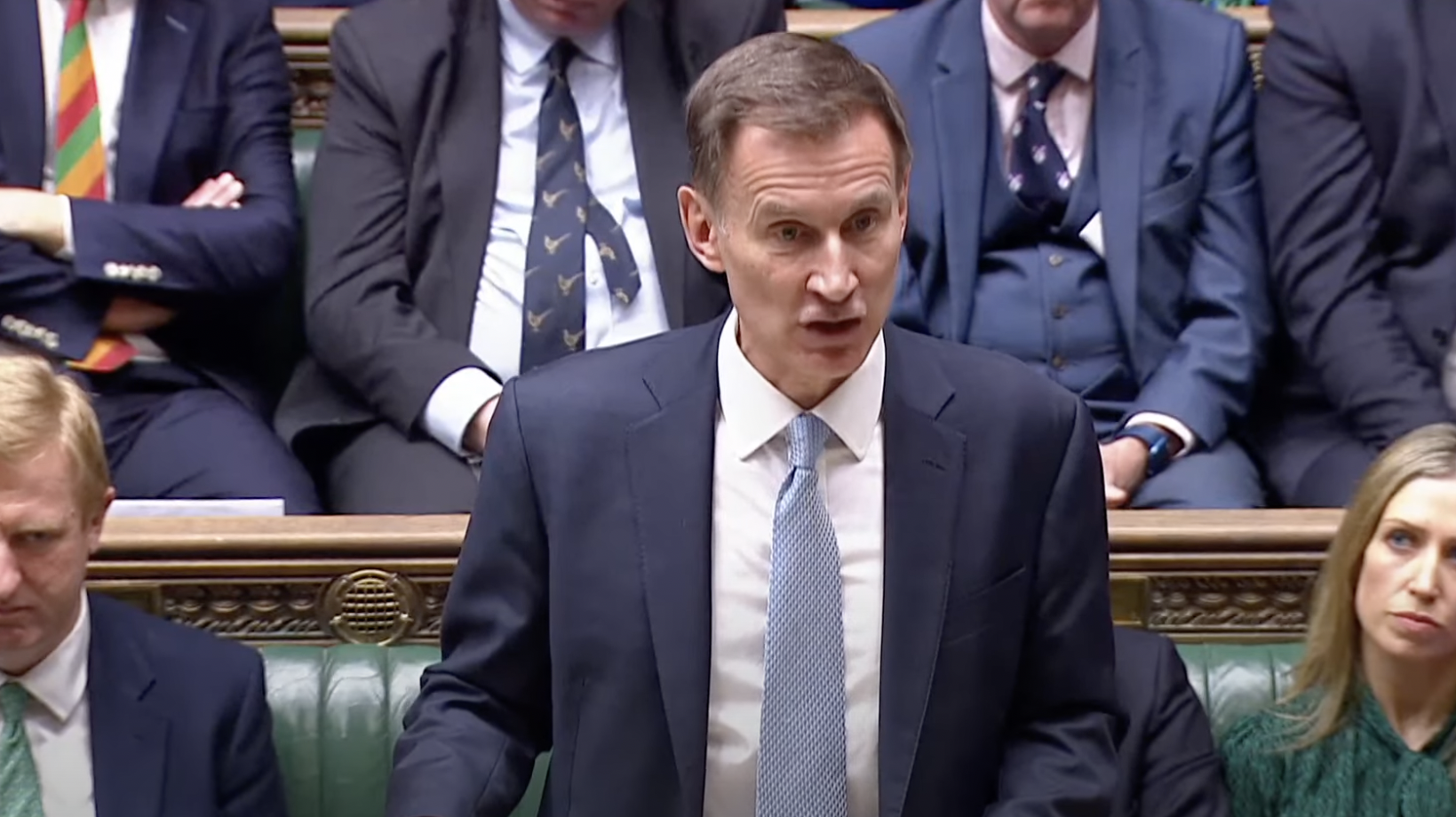

After two previous extensions, councils and even Tory MPs had pleaded with Hunt to extend it. As an example, cut-stricken Nottingham City Council said it would end school uniform support without an extension. However, despite Hunt saying he had listened to charities, they had in fact called for a two-year extension.

Read more about it here.

Increased repayment periods for household emergency loans

The soaring cost of living is pushing families into debt. Hunt announced an increase in the repayment period for new loans, from 12 months to 24 months.

He has also abolished the £90 fee for debt relief orders.

We’re going to get poorer

The big economic acronym you’ll hear is GDP. It’s GDP falling that puts the economy in a recession, and it’s GDP politicians talk about when referring to ‘growth’.

Advertising helps fund Big Issue’s mission to end poverty

But there’s a statistic that’s arguably more important: GDP per capita. This is, roughly, a measure of how much money the country has per person. It’s a good measure of how well-off people feel.

The bad news is, by this measure, we’re going to be poorer in 2028 than we were last Autumn, according to a new forecast from the Office for Budget Responsibility.

You can earn more before paying child benefit tax charges

Hunt increased the amount at which those in receipt of child benefit payments start paying the child benefit charge from £50,000 to £60,000.

Those earning over the threshold can still receive child benefit payments, but must also pay a charge from their earnings. The new rules mean that for anyone earning between £60,000 and £80,000, 1% of every £200 above the new threshold will be charged. For those earning above £80,000, the charge will equal the amount of child benefit.

Hunt’s 2p National Insurance cut will benefit higher earners

The big event of Hunt’s budget is a 2p cut to National Insurance, coming off the back of a previous 2p cut in the 2023 Autumn statement.

This will cost around £9.4bn a year – money which needs to be found elsewhere.

Advertising helps fund Big Issue’s mission to end poverty

How much will it save you? For a worker on £35,000, it’d save you around £450 a year.

Higher earners will save the most – those on £50,000 and above are set to see a roughly £1,300 boost to their incomes.

For somebody earning £20,000 a year, the cut will save them around £260 a year.

In fact, for anyone earning below £38,000, the benefits will be wiped out by a “stealth tax.”

“Any move to put a bit more money in people’s pockets is welcome. But what people really want is investment in their public services – the very services that National Insurance pays for,” said Big Issue founder Lord Bird.

“This is an attempt to boost polling ratings, not give the public the support they deserve. It’s illustrates exactly why the government needs a step-change in fiscal policy – something I have been calling for under a Ministry of Poverty Prevention.”

Advertising helps fund Big Issue’s mission to end poverty

Tax thresholds not being moved means low-income households are hundreds of pounds worse off

Even if they’re not keeping pace with inflation, wages are rising. So while your pay packet may not be stretching as far, you could end up paying more tax, thanks to Jeremy Hunt’s choice not to move income tax thresholds.

It’s known as “fiscal drag”. Workers in England, Wales, and Northern Ireland start paying 20% income tax on earnings over £12,571, then 40% on earnings over £50,271.

Despite a government policy of raising these in line with inflation, they have not risen since 2022, and are expected to be frozen until 2028. Rarely discussed in budgets, it’s a way of raising over £35billion a year. But the ‘stealth tax’ comes at a cost to low-earning workers.

For example, economist Paul Lewis estimated in March 2023 that these would be £14,270 and £57,170 respectively if they’d risen with inflation. That means anyone earning less than £50,271 is £339 worse off a year – enough to wipe out the benefits from the National Insurance cut.

Fuel duty is being ‘frozen’ in the Spring Budget

Fuel duty has been frozen again. The government presents it as a “temporary” 5p cut – but the petrol tax has not risen since 2011.

It will cost taxpayers £5bn a year, research by the Social Market Foundation has found, while the lowest earners will save just £20 a year. Bad news, by the way, if you choose to get the train to save the planet – fares have just increased by 4.9%.

Advertising helps fund Big Issue’s mission to end poverty

A new ‘British ISA’ for savers announced in the Spring Budget

If you’ve got £25,000 to save each year, Hunt has announced a new option for your money. He’s created an additional £5,000 tax-free allowance – on top of the existing £20,000 threshold – but it must be invested in the UK.

There’s a new tax on vapes

A vaping duty is not, despite how it sounds, a fruit-flavoured form of nicotine national service.

Along with a ban on disposable vapes, the government is now taxing vapes like cigarettes and alcohol – with a specific duty.

It’s accompanied by an increased tax on cigarettes – aimed at keeping vaping cheaper than smoking, and keeping the incentive for existing smokers to switch.

The alcohol duty freeze is continuing

Hunt has increased a freeze on alcohol duty until February 2025.

But with costs for hospitality businesses continuing to soar, it remains to be seen whether it’ll halt the march of the £7 pint.

Advertising helps fund Big Issue’s mission to end poverty

99% mortgage scheme has been scrapped

Can something be scrapped if it never existed? Either way, mooted plans for 99% mortgages were conspicuously absent from Hunt’s Spring Budget.

As we explored here, it’s almost impossible to find somebody who thought it was a good idea, with warnings they risked pushing house prices up further, and exposed borrowers to risky lending they might not be able to afford.

Experts have “breathed a sigh of relief” that it didn’t come to pass.