Rising bills and shrinking pay packets are among the factors which will make 2023 a “groundhog year” for families, a think tank has warned.

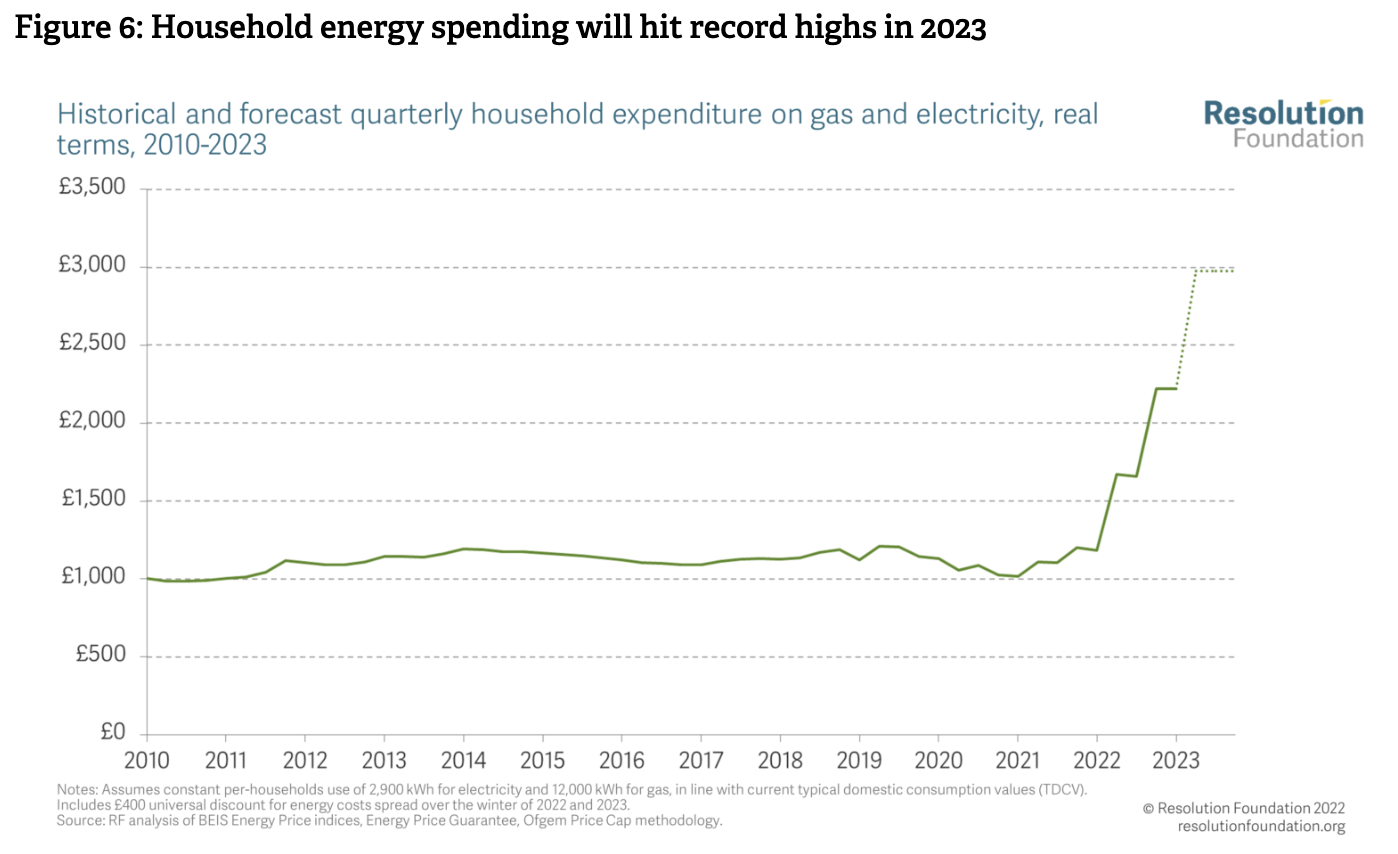

Coming on the back of an average £800 fall in each household’s real disposable incomes in 2022, 2023 will see another similar drop thanks to a £900 rise in energy bills and £700 tax rise for the average household – only slightly mitigated by increases in benefits and minimum wage.

“2023 should see the back of double-digit inflation, but it also looks set to be a groundhog year for family finances: things will get far worse before they start to get better,” wrote Torsten Bell, chief executive of the Resolution Foundation.

Your support changes lives. Find out how you can help us help more people by signing up for a subscription

Around two million households will see their mortgages increase, with an average hit of £3,000 a year for a fixed-rate mortgage.

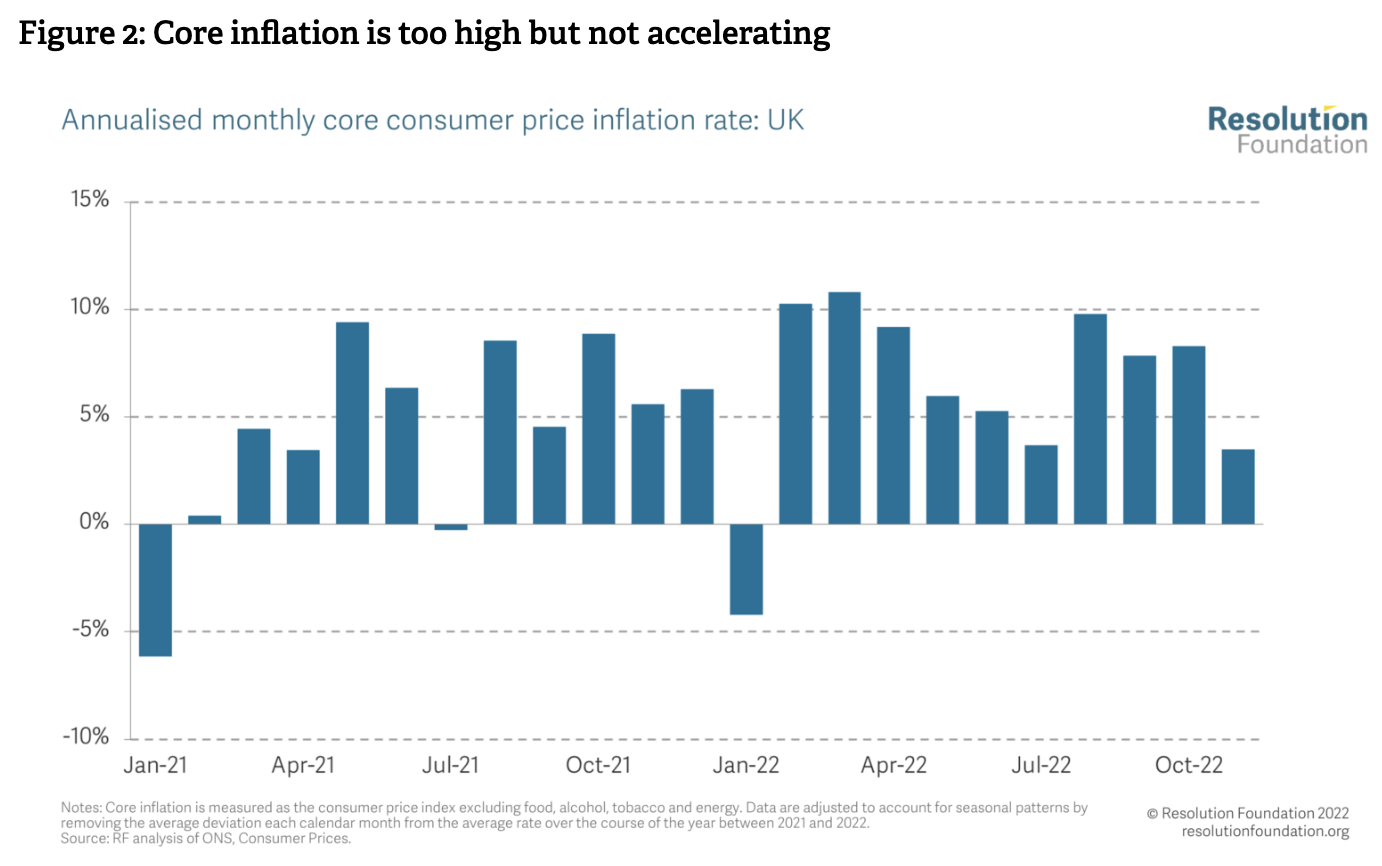

However, inflation is set to fall from record double-digit levels seen in 2022. That doesn’t mean it’s not rising – as long as it is positive, prices are still rising.