In this article I would like to explore the importance of social impact investment, the benefits of breaking from the inertia of traditional allocation frameworks in respect of impact and fiduciary duty in the 21st century.

We heard from senior investment professionals at two global insurance businesses, Aspen and Beazley, who have collectively allocated more than £10m to Big Issue Invest’s latest social impact debt fund.

In a lively discussion, moderated by Jamie Broderick from the Impact Investing Institute, it was clear to the audience that the insurance company’s enthusiasm for the social impact investment theme was determined and tenacious. Surprisingly, this level of commitment was a necessity to undertake the journey they had to take with their investment committees and boards in making the fantastic commitment to our fund.

The social impact funds that Big Issue Invest runs, directly invest in UK-based businesses and enterprises which tackle the causes of poverty and provide solutions to it.

One example is our investment in Smile Together, a social enterprise in Cornwall that offers award-winning high-quality, dental service to underserved communities who would otherwise have poor or no dental provision.

This is the reason why the panellists from Aspen and Beazley believe that the social impact investment theme is one that should have an allocation to.

The inertia of the legacy allocation process.

Regulated asset owners have proven, well-tested, long-term asset allocation and risk management processes ensuring that financial objectives are met by managing financial returns and financial risks within the relevant component of a multi-asset portfolio.

Many of these frameworks have been set up or make thorough use of the now prolific Investment Consultant sector. In the last few decades, these frameworks have been setup specifically to target specific financial risks and returns but were not set up with an assessment of social, community, or environmental impact or the degree to which an investment helps tackle challenging social issues like homelessness or poverty.

To allocate to social impact then, the principal intentionality of the investment, in this case alleviating social issues, must be part of the fund assessment framework.

Where this non-financial outcome analysis has sufficient airtime, our investors have pioneered a trail that demonstrates a way for committees and boards to understand the trade-off between pure financial return and competitive financial returns which also deliver social impact as a primary metric.

What is the fiduciary responsibility in relation to social impact?

Whilst investment allocation frameworks in place today have largely been derived from empirically testing legacy approaches, empirical testing has not involved analysing the positive or negative social outcomes generated from the last four decades of investment allocation policies.

Were it to be tested within for example the UK investment system, it is highly likely that they would show balanced financial returns against risk, most likely negative environmental outcomes from invested assets and average negative social impact outcomes from invested assets (witness a 50% increase in UK poverty levels).

If the sum of private investment in UK assets leaves 22% of the population in poverty, a significant worsening over 40 years, then a typical investment policy must have generated negative social impact whilst creating positive financial returns. This must change.

Either fiduciary duty must factor in the underlying change of social circumstances of communities that an investment asset reaches, or asset owners will need to recognise that fiduciary duty can result in negative outcomes which require a separate investment/risk analysis framework to rectify.

Alternatively, consumers are likely to vote with their feet as insurance product buyers and pension savers (particularly later Defined Contribution pension savers) start to become educated about the lack of impact that their standard investment portfolio generates on their behalf. The customer might then seek to rectify this challenge directly with their purchase choices.

The need for more asset owners to allocate to social investment solutions has never been clearer and relevant.

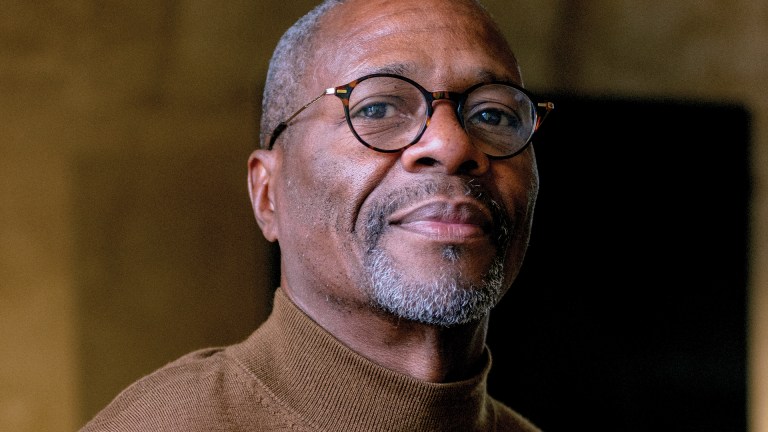

Mark Porter is the chair of Big Issue Invest, who spent most of his career in the investment management sector and leading financial services businesses.