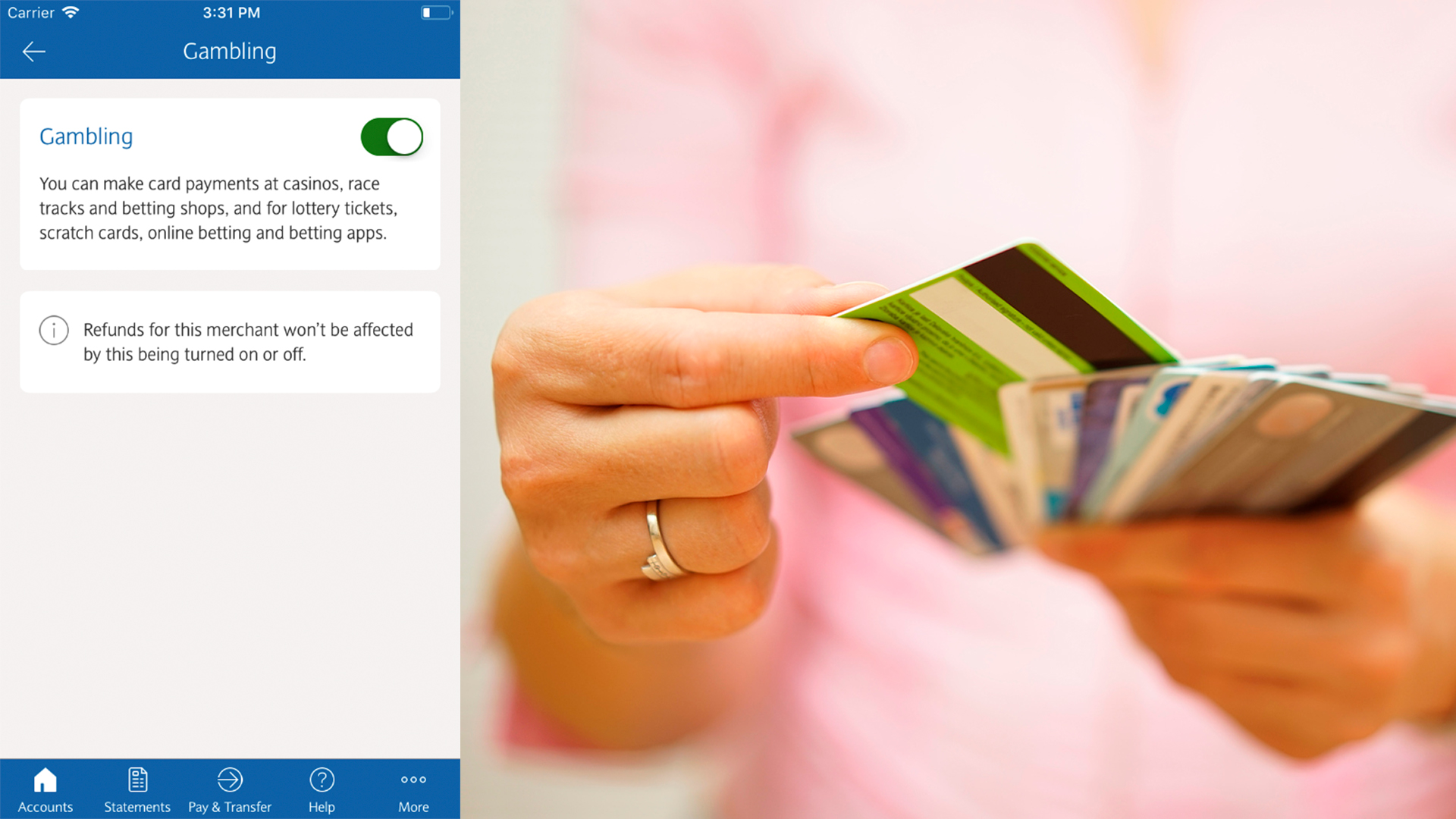

Barclays has launched a feature that will let customers turn off payments to certain retailers in a bid to protect the UK’s problem gamblers.

The new tool allows people to block transactions at supermarkets, restaurants, takeaways, bars and petrol stations as well as bookmakers and gambling sites.

Premium rate websites and phone lines can also be blocked by pressing a button on Barclays mobile banking app.

The financial giant is not the first to offer the service – challenger bank Monzo introduced it in the summer in a bid to “prevent financial problems caused by gambling, rather than trying to support people once they’ve already happened”.

But Barclays is the first mainstream bank to make the move, hoping to protect the UK’s 340,000 problem gamblers and 1.7 million people at risk of racking up thousands of pounds in debt and putting them at risk of damaging their mental health.

Catherine McGrath, managing director at Barclays, said: “We are always looking for new ways to support our customers and make it easier for them to manage their finances. This new control feature is the latest new service that we have introduced in the Barclays Mobile Banking app that aims to give all of our customers a better way to manage their money in a simple, secure and effective way.”