Build a future for your children in more ways than one this Christmas by putting your savings to work and investing in social and environmental causes you care about.

A Junior ISA with The Big Exchange offers tax-free investing for customers and transparency, so everyone knows where their money is being invested. Parents and guardians can build a pot of money for their child while building a positive future for the world they will grow up in.

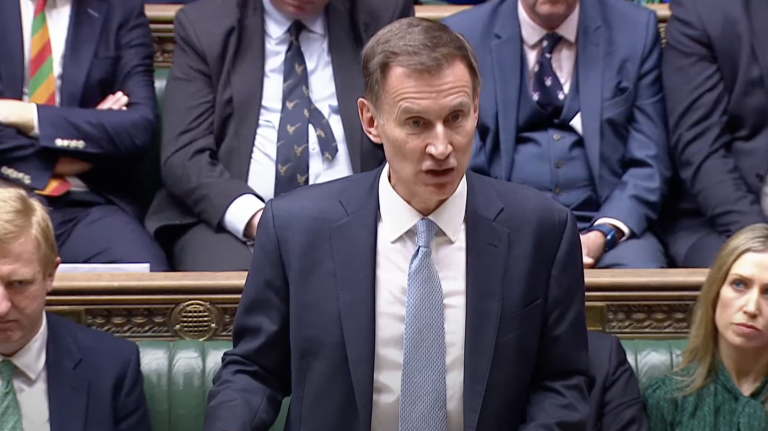

“I like to invest in my child’s future,” says Helen Westhead, who opened a JISA for her four-year-old son Jamie through The Big Exchange. “I was looking for a long-term place to put some money aside. In the context of climate change and everything we are experiencing as a society, I see the future being volatile and uncertain for him and his generation.”

‘I wanted to invest in something that was sustainable and ethical for my son’

Helen and Jamie

Westhead is an environmental and sustainability professional and is also standing for election as the deputy leader of the Green Party in Wales, so particularly wanted to avoid a savings account that would use the money to invest in fossil fuels.

“Our financial systems are so linked to fossil fuels so we need as a society to make significant changes as the time to act on the climate crisis is now,” she says. “We have a real shot in the next decade to mitigate the impacts of climate change that we are already seeing. Divesting from fossil fuels is key to this and now is a sensible time to invest for the long-term future in cleaner, more sustainable finance.

“It did not seem right to be investing in Jamie’s future, while simultaneously putting money in something that was a significant threat to his future. So, I wanted to invest in something that was sustainable and ethical for him.”